We believe that the facts surrounding the purchase of Camberley Shopping are already well established.

An all-party group commissioned an independent report from experts that concluded that the price was fair, and that the purchase was an investment to secure the social and economic future of the community.¹

Councillor Alan McClafferty became Leader in 2019, and began transforming the culture of the Council. Chief Executive Karen Whelan left the Council. Changes were made to decision-making and governance processes. A new Chief Executive was recruited and by 2022 the entire top team at the Council had changed.

The Council’s property assets generate a profit that helps to pay for many non-statutory services, including Camberley Theatre, meals at home, The Hope Hub homeless charity, grass cutting in parks, public toilets, outdoor gyms, dog waste bins.

All borrowers are under financial pressure as interest rates rise. Most of the Council’s borrowings are fixed at 2.7% over 15-50 years.

The Shopping Centre was originally financed using short-term loans, sometimes as low as 0.08%. These were cheaper than long-term loans available at the time of 2.19%. The resultant savings were put into a contingency fund for future interest rate fluctuations, which had built up to £7.3m by March 2023.² £2.0m of this fund was used to balance the 2023-24 Budget.

As interest rates rose from historical lows, £50m was moved to long-term (40 years) fixed-rate @2.9%. The remaining short-term loans have now risen to 3% which will put additional financial pressure on the Council’s finances whilst interest rates remain high.

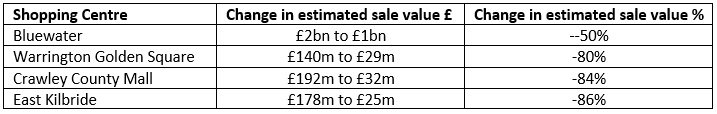

The fall in value is not a case of paying an excessive price for these properties. It is the case that the market price for shopping centres has fallen significantly across the country since 2016:³

Like any investment, any ‘gain’ or ‘loss’ exists purely on paper unless the asset is sold. Any paper ‘loss’ or ‘gain’ on any asset has zero impact on the day-to-day finances of the Council unless it is sold.

When the budget was signed off in February 2023, the Council’s officers described the Council as being in robust financial health with healthy reserves.

There has been no message from official Council channels that suggests otherwise.

Surrey Heath Conservative Association

[1] Avison Young report to Surrey Heath Borough Council - 2020

[2] Surrey Heath Borough Council - Medium Term Financial Strategy 2023/24 to 2026/27 - para 8.6

[3] Montagu Evans report to Surrey Heath Borough Council - 2022